- Woodford Income Focus and Stewart Investors Asia Pacific Leaders among funds removed

LONDON, 30 APRIL 2018: Ten new funds have been added and six funds have been removed from the FE Invest Approved List of funds in the latest review. FE Invest rebalances its list of preferred funds twice a year.

Rob Gleeson, FE’s head of research, said: “Since our last review back in September, what has at times seemed to be an inexorable rise in markets ended abruptly in the new year, with both bond and equity markets taking a simultaneous hit. Ironically this seems to have been motivated by better-than-expected economic news, leading to an expectation of faster-than-expected interest rate rises and an end to the cheap money we have seen since the financial crisis, which occurred over a decade ago.

“The question, as always, is what does the future hold for investors. As well as the green shoots of recovery there are still many potential headwinds on the horizon, not least for the UK economy with the ongoing Brexit negotiations. Predicting where things are going is, we believe, futile and diversification remains an investor’s best defence. The latest changes to our FE Invest Approved List reflect the funds we believe are best at their respective strategies within each asset class - strategies being selected for their suitability in a wide range of scenarios, not just their short-term success.”

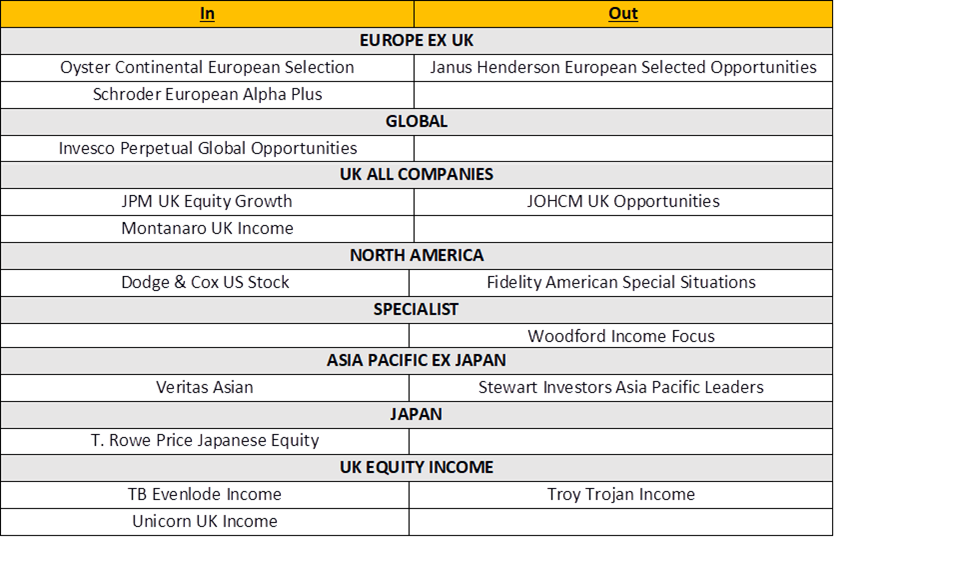

FE Invest Approved List – fund changes by sector

Funds In

Dodge & Cox US Stock has been added because of its value tilt to complement other funds on the Approved List. Charles Younes, research manager, comments: “Although little known here in the UK, Dodge & Cox have been very successful in the US where there are several billions under management in the strategy. The success of the fund is also illustrated by its four FE Crown Rating.”

The Veritas Asian fund is seen as a strong replacement for Stewart Investors Asia Pacific Leaders which has been removed at this review. Younes comments: “The fund is managed with an absolute return mindset. Veritas’s management team looks for structural growth and thematic ideas in Asia, and dive deeply into fundamental analysis to find company-specific opportunities.”

The Unicorn UK Income fund is run by FE Alpha manager Fraser Mackersie alongside Simon Moon, whose philosophy is to invest in growth at a reasonable price. Younes explains: “The fund invests in smaller and mid-sized companies, shunning the large cap market so it can look rather different to other funds in the income space that generate income from large blue-chip companies.”

Funds Out

Woodford Income Focus has been removed at this review. Younes explains: “We have become concerned that too much of the fund is being allocated to smaller companies. There’s been some poor stock selection decisions over the past 12 months and we no longer believe that the talents of Neil Woodford are enough to overcome these shortcomings.”

The removal of Stewart Investors Asia Pacific Leaders is due to concerns that capacity in the fund is continuously being stretched which risks having a negative impact on investor returns. Younes explains: “We continue to rate this fund and its management team highly but feel that there are equally good funds with better liquidity profiles on the Approved List.”

The Troy Trojan Income fund has been removed following a period of poor stock picking for this fund, which has led to some disappointing performance.

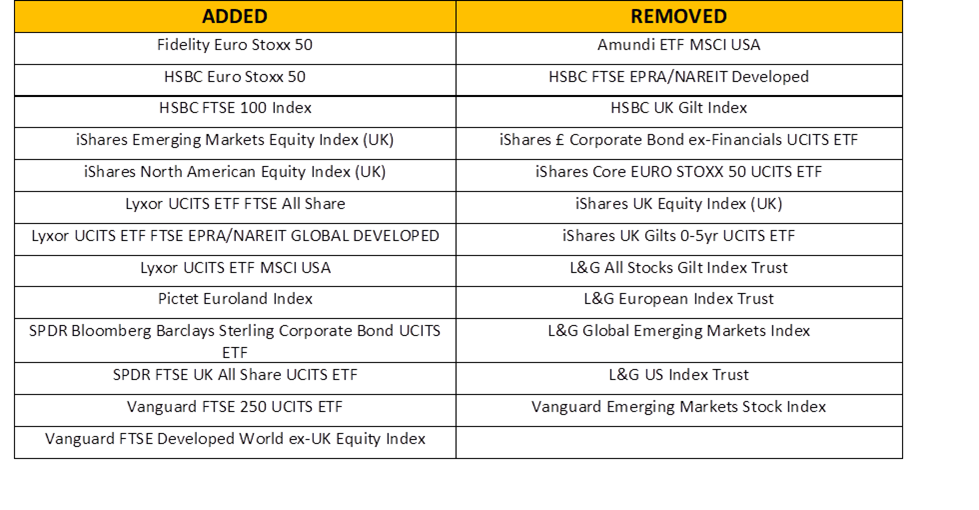

FE INVEST APPROVED PASSIVE LIST

Following the recent Passive FE Crown Rating rebalance, the following changes have been made to the FE Invest Approved Passive List.

Gleeson commented: “We have used the latest FE Passive Crown ratings to determine which funds to add and remove from our Passive Approved List. The ratings check how well a passive fund is doing its job at tracking its benchmark over three years, which is a guide to how well that group will track an index in the future. The difference between the best and worst trackers/ETFs is large and makes a significant impact on the value of your investment.”

FE Invest Approved List Methodology

FE considers all funds available for sale in the UK for the Approved List. FE data and ratings are used to identify a shortlist of top performing funds. A qualitative selection criteria is then applied to produce the final recommended list.

FE accepts no payment from any of the fund managers for their participation in the ratings or review process, or for their inclusion in the shortlist.

-ENDS-