- 2018 Fund Watch list: Woodford Income, Jupiter Absolute Return and Allianz Strategic Bond

- 2017 takeaway: Don’t follow herd mentality

- House view on UK equities and corporate bonds more positive heading in to 2018

LONDON, Monday 11 December 2017

FUND WATCH LIST

Research manager, Charles Younes, comments on three funds that the FE Invest team will be watching closely in 2018.

Woodford Income Focus

Neil Woodford’s recent misfortune has been covered extensively. If he wants to change the direction of the flows to his fund, he can’t afford another year of underperformance. Relative to his UK equity income peers, Woodford has already reached his longest period of underperformance.

Neil Woodford’s fortunes could change quickly as he has not hesitated to take contrarian bets. He is one of the few fund managers to openly admit that he sees Brexit as a buying opportunity. For instance, he has been building stakes in UK banks, retailers and housebuilders.

Woodford has also backed his stock-picking, despite poor performance. He has retained such names as Provident Financial, Astrazeneca and Prothena, despite recent attacks from short sellers. Investors tend to expect managers to acknowledge losses when they make losses, instead of falling in value traps – next year Woodford will have to prove that he has not fallen prey to these misconceptions.

Jupiter Absolute Return

James Clunie took over the reins of Jupiter Absolute Return in 2013, bringing his short-selling experience to the asset management company. To return positive performance, Clunie aims to exploit inefficiencies in global equity markets. This means he prefers a more volatile environment, as rising then falling markets should help both sources of alpha (the long and the short book) to generate positive return. Higher volatility also means a greater number of opportunities to take advantage of, as the behaviour of investors is often irrational.

Despite the low-volatility environment, Clunie has managed to limit losses this year to -2.98% (as of 5th December 2017) by cutting the fund’s gross and net exposures. This also highlights his strong understanding of his investment process and the macro environment. Nevertheless, unit holders will expect a stronger upturn in performance if 2018 brings volatility back on global equity markets.

Allianz Strategic Bond

It was a difficult year for the recently appointed Mike Riddell. We believe recent performance does not fully reflect the changes that he has made since taking control in November 2015. Riddell aims for a “genuinely strategic” portfolio, by which he means a fund with a low correlation to global equities and which moves strategically between different parts of the bond market depending on where the opportunities lie. He adopts a broad global bond index as his benchmark and aims to outperform it by allocating equal amounts of his bets to interest rate positioning, corporate debt, currency positions and inflation positions.

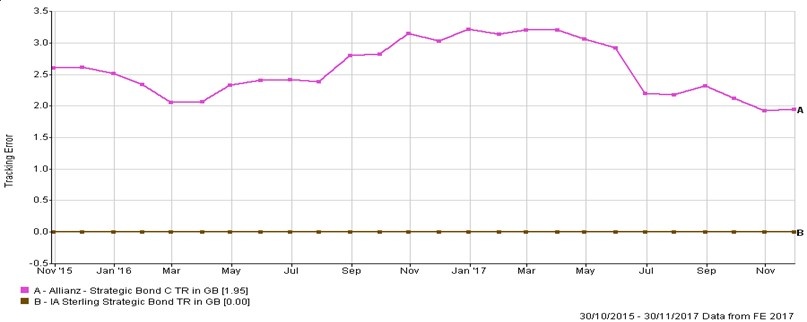

The even split between rates, credit, inflation and currency is attractive: most strategic bond managers are essentially managing credit plus interest rate duration. We believe this fund is interesting as it shouldn’t behave like most strategic bond funds, as highlighted by the current tracking error of 2.5% relative to the sector. If credit outperforms again, we should see Riddell’s bet to diversify the alpha generation disappoint investors again.

BIGGEST TAKEAWAY OF 2017:

Oliver Clarke-Williams, portfolio manager:

- Don’t be influenced by herding mentality - “For years now we have been hearing about how gilts are a massive bubble waiting to blow up as soon as there is a rise in interest rates. Yet, year to date we have again seen that gilts have made a small profit despite seeing the first interest rate hike in about a decade. Importantly gilts have maintained the properties that we like about them, the correlation between them and equities remains weak, they add significant diversification benefits and provide protection in falling markets.”

ASSET CLASS VIEWS – 2018

Charles Younes, research manager:

- Neutralise UK equities (previously negative) – “The BoE’s management of the expectations around the recent rate meant that bond markets were not disrupted. We also believe political risk is now priced in to UK equities and that these stocks are unlikely to be as sensitive to Brexit negotiations as they were this year, so there is little downside.”

- Neutralise corporate bonds (previously negative) – “Our negative outlook was mainly driven by the end of the Bond Purchasing Programme by the European Central Bank. In October, Draghi did announce a cut from €60bn to €30bn from January. He also announced an extension until at least September 2018 so we are reassured that the technical support for corporate bonds remains, even if we see more interest rate hikes next year.

“Corporate bond spreads generally fall during expansionary phases of the business cycle as corporates reach their highest level of profit. Until there are signs the business cycle is turning, spreads should continue to tighten. We currently don’t see signs of inflection in the short term.”

FE Invest, FE’s range of discretionary model portfolios offer advisers investment options to suit a complete range of investor risk profiles and a variety of investment objectives. The suite of risk-optimised portfolios are built using a unique investment process driven by FE’s industry renowned ratings system, comprehensive fund data and cutting edge technology with the oversight of experienced professionals. This ensures that the portfolios are well optimised within their risk bands and are completely free from bias.

-ENDS-

For more information, please contact us