Retirement planning used to be simple, an investor had a long period of accumulation which ended up with the buying of an annuity at retirement which provided a guaranteed income until death. Pension freedoms changed everything as investors are now much likely to enter drawdown in retirement. This has been combined with a period of very poor annuity rates, meaning that these are now seen as very poor value by many entering retirement.

Risks at retirement

The risks in retirement are far more complicated than the risks in the accumulation phase. The largest risk is shortfall risk, simply the risk that you will run out of money during your retirement. This is obviously complicated by the fact that none of us can be sure how long we are going to live. Logically therefore it may seem that the best approach is to take as high-risk approach as possible in order to continue growing your money during retirement. In fact, the research that we have done suggests this is the correct approach to take in the majority of cases, as you give your money the best chance of lasting as long as possible.

There is however a rather large caveat to this, in that it also leads to a significant minority of people running out of money in the early years of their retirement due to sequencing risk. This is when a sudden drop in markets during the early phase of your retirement leads to substantial losses in your pot. The investor is then forced to start drawing an income from their investment before it has recovered, meaning they are taking a larger percentage of their pot than anticipated and further depleting their already ravaged pot. The solution to mitigating sequencing risk is merely to take risk off the table, but that’s not an option as most of us will not have enough money to retire on and are relying on continuing to grow our pot during retirement.

So how do you balance these risks? As it seems that the trick to managing drawdown is to take high risks except in the situation where you really shouldn’t. And unfortunately, none of us have a crystal ball to predict when a market correction may occur. The need for protection seems particularly pertinent at the moment as we have experienced a decade long bull market and signs that volatility is starting to creep back into markets. However, we cannot rule out the fact that markets could continue to rally for another decade, meaning that taking risk off the table would be foolhardy.

A solution to navigating these risks

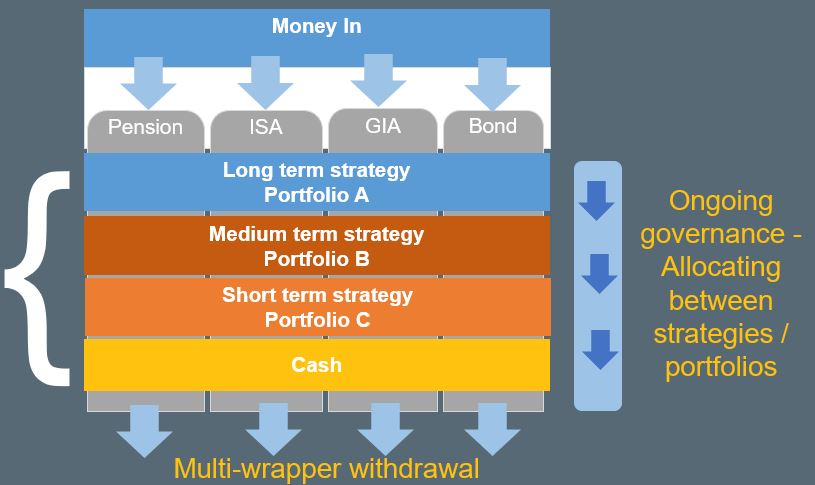

One possible solution is not to look at your pot as one large investment portfolio, but as two or three different portfolios that have different objectives and time horizons and therefore different risk exposures. Shortfall risk is probably the biggest risk that you face in retirement, therefore it makes sense to have the majority of your portfolio allocated to a high risk long time horizon investment strategy. Smaller pots with a lower risk and shorter time horizons can then be employed to provide protection against sequencing risk.

To take an example during the financial crisis of 2007/2008 it took approximately three years for markets to return to their previous level. This is the sequencing risk that investors are exposed to. In an ideal situation therefore you do not want to be drawing from your high-risk portfolio during this period as you want to give it time to recover. Instead you would be drawing from your lower risk portfolio which would predominantly be made up of cash, bonds and absolute return which would not experience the drawdown of the high-risk portfolio.

Selecting suitable investment solutions

Risk and term therefore go hand-to-hand in retirement planning. The FE Invest model portfolios reflect this by offering a suite of 34 portfolios - each created using a risk-optimised asset allocation strategy that targets a certain risk level and term objective - giving advisers the ability to use a particular mix of the various models as required and adopting a flexible approach to retirement planning.

Speak to us today to find out more about FE Invest - [email protected]