The interest in responsible investing has recently increased manifold.

The Department for Digital, Culture, Media and Sport has told Advisers and trade bodies to increase their focus on impact investment following the launch of the recent paper on Growing a Culture of Social Impact Investing in the UK.

This is reflected in wider society - as recent study by YouGov for Good Money week revealed that 47% of UK adults said they wished their money to be invested with an element of making a positive difference. Similar research from the UK Sustainable Investment And Finance Association showed that 57% of investors felt that investment managers have a responsibility to ensure the companies they invest in on their behalf are managed in a ‘positive way’.

This demand for sustainable investing is driven largely by millennials who are poised to receive more than $30 trillion of inheritable wealth (EY research).

Introducing the FE Invest Responsible Portfolio Range:

As you may have seen in the press, we have recently launched a suite of Responsibly Managed Portfolios. The new range is designed specifically to provide Advisers with robust investment options for clients seeking clean/conscious investing with the assurance of consistent returns.

The Responsible range offers three risk-optimised portfolios to suit multiple investor risk profiles.

In true FE Invest style, the portfolios can also account for investment term and are currently mapped to medium term (most popular amongst our existing 31 portfolios), as we look to roll out short and long-term variations based on demand.

Methodology:

As with FE Invest’s Active and Hybrid range, the Responsibly Managed Portfolios are built using a unique investment process.

FE’s ratings system and comprehensive fund data are used to create an initial shortlist of funds, forming the FE Approved List. Our team of analysts review each fund on the list to select those with an Ethical or Sustainable focus within their investment mandate. Specialist technology is subsequently used to combine funds that will give each portfolio the appropriate level of volatility and largest diversification benefit.

Blended approach:

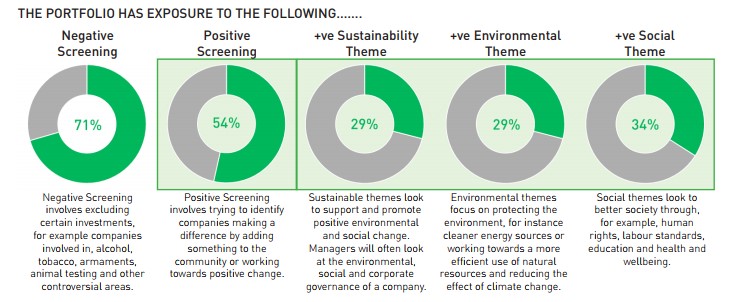

Responsibly managed is an inclusive term used by FE analysts to refer to the use of both Ethical and Sustainable funds. Ethical funds avoid investing in unethical sectors such as tobacco and arms dealing (avoidance - negative screening), whereas Sustainable funds invest in areas that make a positive impact on the environment or society (positive screening).

The FE Invest portfolios carefully blend themes and styles to maintain diversification and to ensure that the portfolios make a positive impact in terms of assets invested and returns for the investor.

Gilts and property are also included in the mix and are considered neutral.

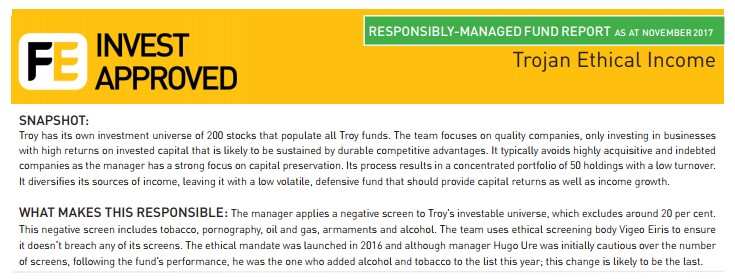

Example of negatively screened fund in the portfolio:

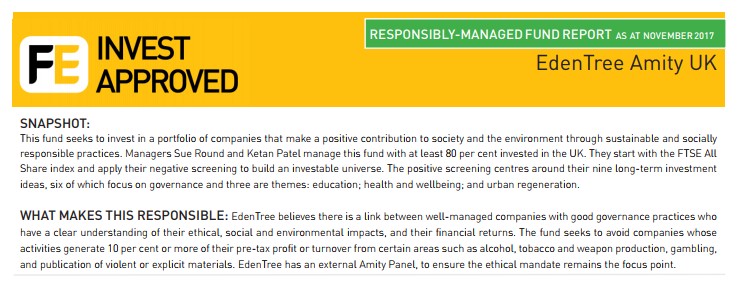

Example of a positively screened fund in the portfolio:

Our new model range aims to support advisers in providing a valid and ethical investment portfolio choice to their clients. We provide content and reporting to demonstrate the impact of investing in more ethical portfolios and our portfolio factsheets are tailored specifically for conscious investors highlighting the responsible factors rather than traditional factsheet elements like asset allocation.

Contact us for more information on the proposition or to request a factsheet at [email protected]