- Architas and PIMCO place in the top three fund groups by number of 5 FE Crown Ratings for the first time

LONDON, 21 JANUARY 2019: FE’s latest bi-annual Crown Fund Ratings rebalance[1] has awarded 336 funds with the highly-prized 5 FE Crowns, of which 16 are newcomers and 51 have jumped two or more FE Crowns to achieve the top accolade.

FE Crown Ratings are calculated by building up a ‘Crown score’ made up of three parts; an alpha based test, a volatility score and a consistency score which are applied to the fund’s performance over the last three years.

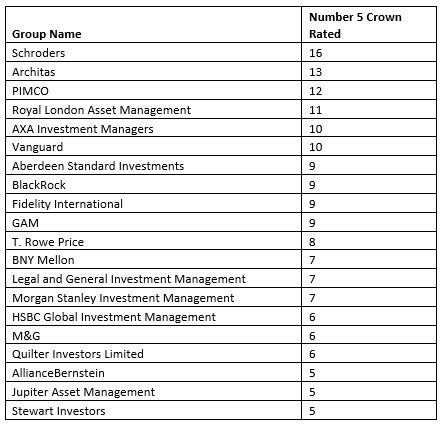

Based on outright numbers of 5 FE Crown Rated funds, Schroders retains its top spot in the group league table[2] at this rebalance with an increase to 16 funds from 11 in July 2018. Second place goes to Architas which more than doubled its number of 5 FE Crown Rated funds from six to 13. PIMCO are a close third with 12 funds, up from five at the July rebalance.

Charles Younes, research manager at FE, comments: “Considering that neither Architas nor PIMCO has appeared in the top five groups before, to achieve a top three place is outstanding. Most of PIMCO’s fixed income funds have seen upgrades at this rebalance reflecting the strong performance across the range. Architas’ leap up the table can be explained by the dominance of multi asset, volatility managed funds in their range and this strategy worked well in a volatile year like 2018.”

Previously unrated funds receiving 5 FE Crowns

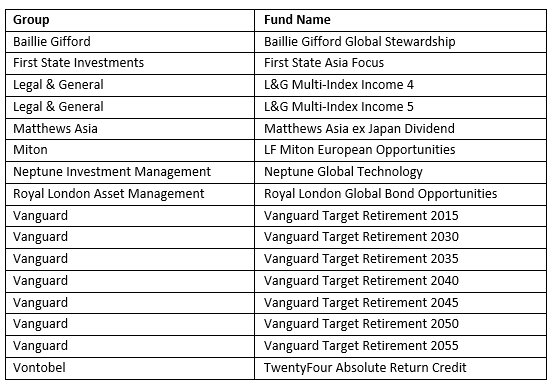

Funds must have three years of history to qualify for a FE Crown rating. At this rebalance, 16 previously unrated funds have achieved the highest ranking of 5 FE Crowns. Among these are Baillie Gifford Global Stewardship, First State Asia Focus and Royal London Global Bond Opportunities[3].

Seven of Vanguard’s Target Retirement funds also achieved 5 FE Crowns for their first rating.

Tanvi Kandlur, senior fund analyst at FE, comments: “These funds are multi asset and volatility managed which, like Architas’ range, have done very well in a volatile market.”

Sectors

The Asia Pacific (ex-Japan) equity sector stands out at this rebalance with 51% of funds being awarded either a 4 or 5 FE Crown Rating, up from 40% in July 2018.

Kandlur comments: “A lot of income funds in this sector did very well in 2018. These funds tend to be biased to defensive sectors that pay high dividends and protected better on the downside in 2018. Previously these income funds had underperformed by a big margin, purely because they could not hold a lot of Chinese technology stocks, most of which do not pay dividends, which were driving the market in 2017.”

Conversely, 50% of European (ex UK) equity funds saw a FE Crown Rating downgrade at this rebalance.

Kandlur comments: “Most of the funds downgraded have a strong growth tilt and are concentrated in nature which did very well in 2017. However, in 2018 some European managers saw several stocks sell off significantly post earnings misses, which hit the concentrated funds hardest.

All sectors have seen some churn in the ratings of their funds and 48% of funds have gained or lost FE Crowns at this rebalance.

Upgrades

There are 51 funds upgraded by two or more FE Crowns to achieve the top accolade of 5 FE Crowns at this rebalance.

One of the largest funds by AUM upgraded at this rebalance is Schroder Recovery moving from a 2 to a 5 FE Crown Rating.

Amy Kennedy, fund analyst at FE, comments: “This fund has outperformed over three years with strong performance in 2016 and 2018 due to the fund’s large-cap bias, foreign equity allocation and cash holdings which helped protect against the downside in both years. The fund’s value style would also have contributed to returns following the post-Brexit rally in 2016, for example.”

AllianceBernstein’s AB Concentrated US Equity Portfolio has also seen a move from 2 to 5 FE Crowns. Younes comments: “This fund has recorded strong performance relative to peers and the S&P 500 index. It is highly concentrated with around 20 names, so the impact from good stock-picking is magnified.”

FE Crowns Rating methodology

FE Crown ratings are calculated by building up a ‘crown score’. The score is made up of three parts, and each part is calculated by reference to a benchmark for the fund. Once the benchmark is assigned, FE then applies three tests (an alpha based test, a volatility score and a consistency score) to the fund’s performance over the past three years. Three years of history is required to carry out these scores, so any fund with less history than this will not qualify for a rating.

Funds are assigned ratings based on their total scores, according to the following distribution:

- the top 10% - 5 FE Crowns

- the next 15% - 4 FE Crowns

- the next 25% - 3 FE Crowns

- the next 25% - 2 FE Crowns

- the bottom 25% - 1 FE Crown

Charles Younes, FE research manager, said: “We rate all funds with a three-year history and we do not charge anyone for this service. We believe that quantitative ratings have an important role to play in supporting accurate and fair comparisons of historic performance but not future performance. Our objective is to make the market more transparent and accessible – ultimately it’s about helping people make better investment decisions.”

[1] All IA sectors

2 For Top 20 Fund Managers by 5 FE Crown Ratings, see notes to editors

3 For full list see notes to editors

-ENDS-

NOTES TO EDITORS

Top 20 groups by number of 5 FE Crown Rated Funds

About FE

FE is a leading international provider of data and technology to the asset management and wealth management industries, with clients ranging from the world’s largest asset managers and banks to financial advisers and distributors. FE connects these groups to enable better informed investment decision making, providing data, documents, tools, research, ratings and model portfolios. In November 2018, FE joined forces with two fund data businesses based in Europe ꟷfundinfo (Switzerland) and F2C (Luxembourg). This combination harnesses the complementary capabilities, reach and resource of each firm, increasing the breadth and depth of the client offering and positioning the firm for rapid international growth. FE employs c.600 people across UK, Switzerland, Luxembourg, India, Australia and other European and Asian centres.

Media Contact

James Hoey

FE Marketing Communications Assistant

T / +44 207 534 7620

For more information, please contact the FE press office at: [email protected]