The last decade has seen a steady increase in the use of DFM run Model Portfolio Services by financial advisers. However, many advisers struggle to conduct detailed ongoing analysis on their providers and with the current unpredictable economic outlook set to continue, its vital that they can access to up-to-date performance data for their outsourced portfolios.

The trend towards outsourcing looks set to continue with increased regulatory and administration requirements pushing advisers to look for greater efficiency savings. This year’s FE fundinfo Adviser Survey saw the number of advisers who reported using an external DFM rise to 57%, the first time in five years of running the survey that more advisers reported using a 3rd party providers than did not.

Advisers spend a great deal of time and effort conducting due diligence when choosing a new provider, researching key factors such as historical performance, investment methodology, service and cultural fit. However, being able to closely monitor your DFM with up-to-date data should also be of equal importance.

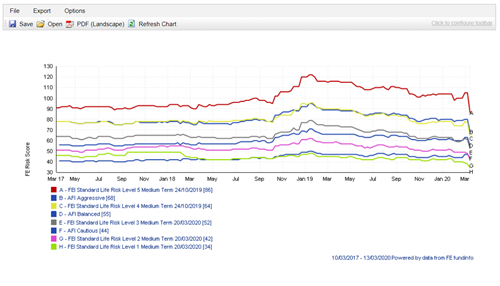

The MPS Directory, available via FE Analytics, now has over 50 of the UK’s most commonly used MPS Providers listed. The Directory allows you to access and monitor your discretionary managed portfolios, compare your clients’ model portfolios with benchmarks of your choosing and access the underlying holdings data of the model portfolios your clients are invested in. You can also chart the performance of those outsourced portfolios up to and including the very latest pricing.

Rather than having to manually model every fund switch and rebalance yourself, we update DFM models direct from the providers in our system to ensure you have access to full, accurate and up to date performance history.

One of the common complaints when looking at the topic of model portfolios is whether you are comparing apples with apples due to the variety of terminology and benchmarks used by providers. Our FE fundinfo Risk Score presents an easy to understand measure of volatility relative to the UK large cap index of the 100 largest companies – demonstrating the consistency of a portfolio’s risk profile in both the immediate and long-term, when compared to the market.

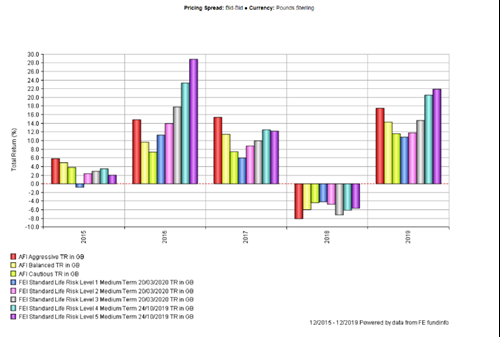

Another tool available within FE Analytics is the FE fundinfo AFI (Adviser Fund Index) indices, which allow you to compare your portfolios against those bought by a panel of influential and respected discretionaryadviser firms. These can be used to benchmark the performance of a model portfolio over longer term rolling periods, or discrete intervals such as the last 5 years.

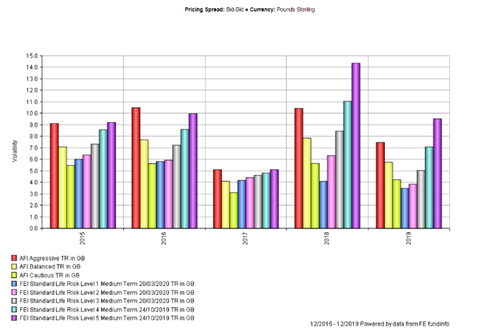

Our bar charts offer 18 different measures to help you review risk and reward profiles, including volatility.

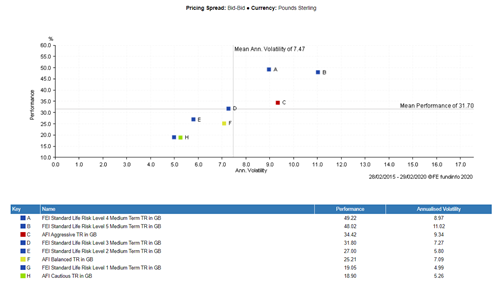

You can also compare the risk and reward profile from a range of Model Portfolios over longer and shorter-term periods. Our scatter charts offer a great way to present this against their benchmarks or in contrast to a client’s existing proposition.

The MPS Directory was set up to help advisers conduct detailed ongoing analysis on their chosen model portfolio providers and bring a new level transparency to model portfolio research. It helps advisers demonstrate the impact of their advice, as well as improve their due-diligence, portfolio selection and reporting.

At FE fundinfo we also have our own Model Portfolio Service, FE Investments. FE Investments provides a range of risk-targeted portfolios, leveraging our expertise in fund data and software."

If you'd like a live demo of FE Analytics and the MPS Directory or would like to learn more about FE Investments, please get in touch and speak to one of our specialists.

*All charts show *FE Investments own models via the Standard Life platform.