‘Outsourcing’ has been a big buzzword over the last few years. From support desks to software development - outsourcing for operational and business efficiencies has become popular, even in financial services. In the Financial Advice industry, there has been a more recent trend towards outsourcing investment solutions to DFMS - giving third-party discretionary fund managers, the permission to invest and rebalance client portfolios. However, given the onus on Advisers to ensure they remain accountable for the investment selection for an individual client, does the term ‘outsourcing’ truly reflect the reality?

Advisers use Discretionary managers for a variety of reasons including their specialist resources and time-saving. Many Advisers have felt they lack the time and expertise to be able to research the whole market of funds in order to create portfolios for clients and have moved towards solutions that offer that service for them.

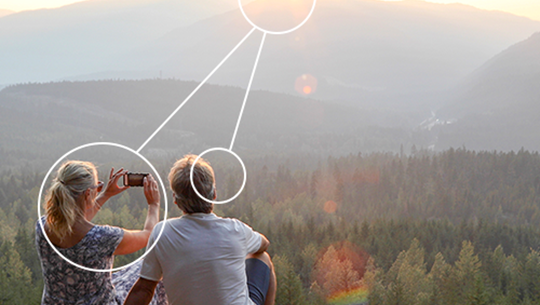

However, when it comes to the final decision making on client needs, the responsibility of getting it right rests solely with the Adviser. So, far from outsourcing the investment part of the financial planning process, Advisers should consider their discretionary partners as insourced experts who complement their overall client proposition offering. Given the significance of this relationship, it is imperative that Advisers conduct appropriate due diligence on any such provider. Below we explore five key drivers to consider when looking to insource expertise to enhance your overall investment proposition.

Investment process

Advisers use Discretionary Managers in pursuit of consistency of investment returns and effective risk management. So, the first step naturally is to understand in detail how the provider’s portfolio construction methodology aims to achieve this for investors. Does their process suit your inhouse investment philosophy? And more importantly are you aware of how independent and unbiased this process is?

Whilst there is no one right way – you are likely to gain insight on the robustness of a firm’s process by looking at the amount and nature of research that goes into creating the portfolios. Does their research draw on unbiased, comprehensive data? Is there an over-reliance on numerical analysis? Is it independently verified by a third-party?

Scope of proposition

Investor goals are varied - from ethically minded millennials to income chasers to retired clients in decumulation. Advisers cannot and do not want to shoe-horn clients into a one-size fits all solution. However, managing this level of variety, especially on platform can be cumbersome and expensive.

Although working with a discretionary provider with models managed on platform can help with costs, it is important to understand if the scope of their proposition will address the variety issue. In other words, does their proposition offer enough investment options to suit a wide range of client needs?

A majority of DFM models distinguish clients based entirely on their attitude to risk, mapping their models to different risk levels. Arguably, this is insufficient to truly achieve investment success for clients. Look for providers that offer a broader scope by offering term-based options that reflect how long the client plans to invest their money.

Governance reporting

Regular governance reporting in the form of fund reviews, portfolio analysis, rebalancing reports and so on are a prerequisite and should form an integral part of the service level commitment from a discretionary partner. More recently, as required by MiFID II, the suite of governance reporting should also include a valuation report/ notification for when a portfolio falls by more than 10%.

Good governance reporting should also enhance your investment knowledge and equip you with high-quality investment analysis, information & resources to keep you up-to-date, in order to be able to advise your clients appropriately. Most discretionary managers have teams of investment analysts who produce valuable content. Before partnering with a discretionary provider, seek to understand how you can access this and how frequently.

Client relationship

By insourcing the investment requirements, you maintain full control of your client relationship. A good discretionary partner will help you enrich this relationship by creating investor focused communication, material, reports and more that can be white-labelled with your firms branding for onward circulation to investors.

Ensuring suitability

Over the last few years, there has been a proliferation of discretionary providers in the UK offering model portfolios and discretionary investment services. Unlike other investment types, DFM & MPS providers have been notoriously hard to analyse and compare.

Ensure that any provider you choose to work with allows you to get under the bonnet of the models to get a better picture of what’s on offer and to compare against any other or against a client’s existing portfolio. Solutions like FE Transmission now make this possible allowing Advisers to conduct holdings level analysis of ready-to-use portfolios and to create bespoke comparisons.

------------------------------------------------------------------------------------------------------------------------------------

The areas covered in this post are the principles on which FE’s own discretionary service to Advisers is built. Please contact us on [email protected] for more information or simply request a factsheet here.