Performance, risk level and costs are key elements in establishing investment suitability. Whilst undertaking replacement business, regulation requires advisers to conduct comprehensive cost comparisons, by factoring in all costs (not just a ‘headline’ annual management charge) associated with the existing solution against the recommendation. Advisers are required to identify and justify any additional costs involved in investing that could impact the client’s objectives. Ideally, this would include initial costs, exit charges, adviser fees, platform charges and so on.

It’s not news that conducting these cost comparisons can be rather challenging, given that - not only does this process have to satisfy the regulator; but ought to communicate a compelling case for a transfer to the client in a clear manner. Many advisers are faced with the difficulty of finding the comparable level of charge information and routinely rely on projection data to identify and demonstrate the impact of charges on real returns, particularly if the investment recommendation is for a pension. Although the FCA does not call this bad practice, from an administrative perspective, it is very laborious and time-consuming.

Cost comparison and pension transfers

A significant amount of replacement business currently come from pension transfers. Historically projections on existing plans were obtained straight from the provider and compared to projections on the new plan, to provide the cost comparison and show the monetary impact of the charges. This is a lengthy, manual process, with waiting times going into weeks and the adviser having to make sense of the multiple product provider projections.

Another limitation of this method of comparison is that they don’t always factor every type of charge (common example- adviser charges). Also, they aren’t wholly objective as they are being generated by the product provider. Comparing the projections to the explicit charges a company has provided do not always match, which can be extremely complicated to explain to clients.

The case for Reduction in Yield

Instead of relying on projections - a simpler and more efficient approach to assessing the impact of costs on a portfolio is to calculate the reduction in its yield (RIY) after accounting for associated costs such as set up charges, exit penalties, ongoing charges, adviser charges, provider and fund charges. Alongside being more inclusive in terms of costs considered; the reduction in yield offers investors a singular figure of cost impact on future returns - making it far more intuitive for clients.

This method of cost comparison is not restricted to pension transfers and can be used across the board for any investments such as bonds and/or ISAs. But how do you ascertain the reduction in yield without accurate, comprehensive, up-to-date charges data? How do you bring all this data together to calculate the compounded impact of charges? The FE Analytics Reduction in Yield Calculator does exactly this.

Introducing the FE Analytics Reduction in Yield calculator

FE Analytics’ ISO certified data collection processes collect a variety of charges data from investment providers. Users of FE Analytics have access to these charges alongside the capability of entering their own charges (adviser charges) and any platform charges, in order to truly ascertain the yield/returns of their proposed portfolio against the client’s existing arrangements.

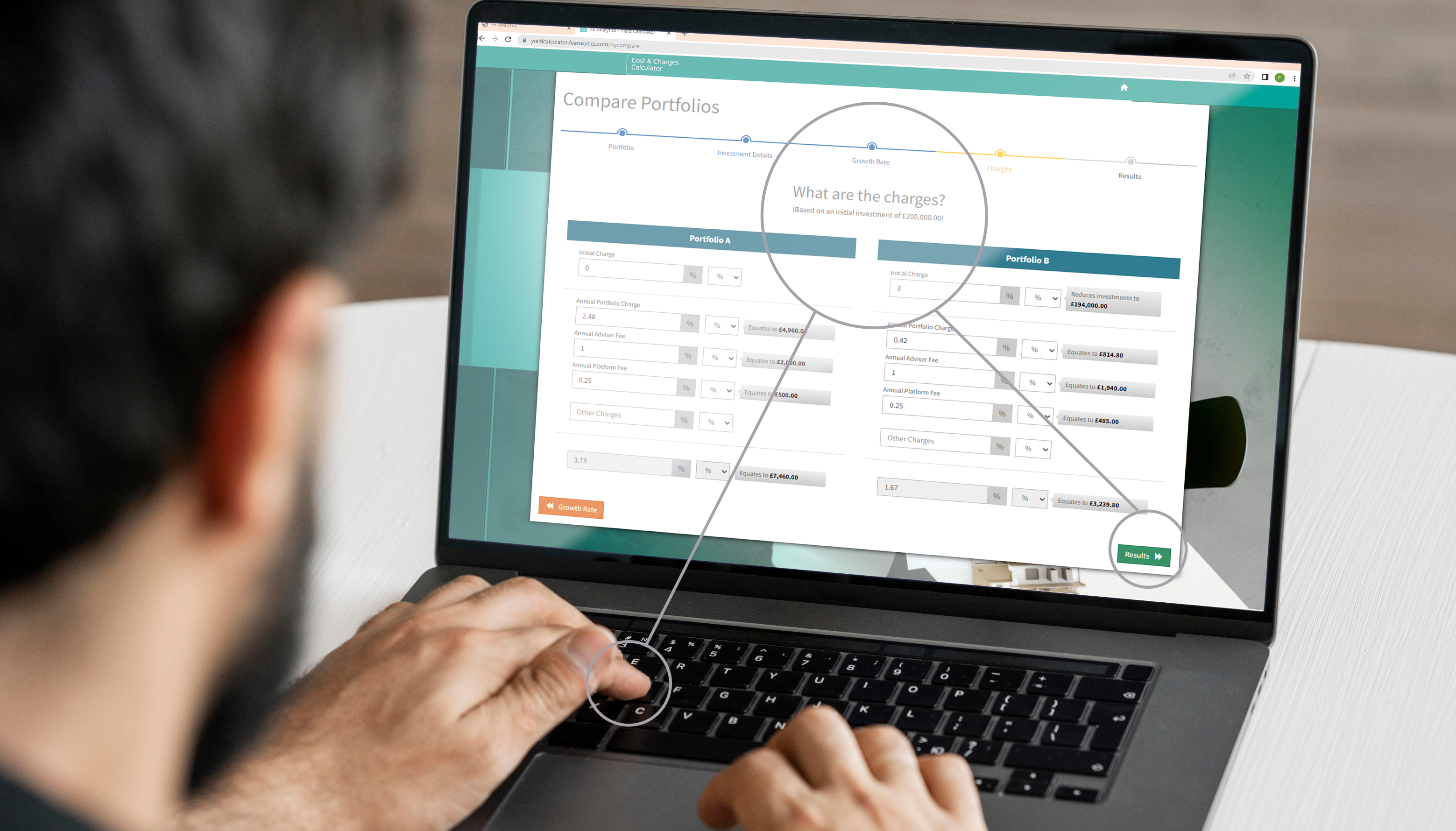

The FE Analytics Reduction in Yield Calculator draws on these capabilities to offer advisers a tool to easily calculate and compare the impact of costs on the yield of one or more portfolios viewed side by side across customised growth rates and time periods.

The calculator is fully independent, compliant and comprehensive enough to be used for all investment types. The RIY calculator makes cost comparison a truly transparent process. With its user-friendly interface, the calculator can be used in front of clients during meetings and the outputs generated by the calculator can be exported for use in client reports to help bring your recommendations to life and demonstrate the value of your advice to your clients.

As an ever-increasing number of advisers and paraplanners turn to the use of the reduction in yield approach to cost comparison, we believe that an independent, unbiased calculator will add significant value to the practice.

If you would like further information on how to get the most out of the tools within FE Analytics, please don't hesitate to get in touch.