The FE fundinfo Crown Fund Ratings are rebalanced twice a year. The first rebalance of 2018 has given 324 funds the highly-prized five FE fundinfo Crown Rating, of which 15 are newcomers and 54 have jumped two or more Crowns to achieve the top accolade. The funds are spread across sectors with all the IA sectors seeing some churn in the ratings of their funds - 45% of funds within the universe (a total of 1345) have gained or lost Crowns at this rebalance.

The IA Japan sector emerged as champion with 45% of the sector's funds receiving a 4 or 5 FE fundinfo Crown Rating and 37 of the 56 funds being upgraded since the last rebalance. Joining Japan, other sectors that have had a strong showing this rebalance include China and Asia Pacific ex Japan with 41% of funds in each receiving a 4 or 5 Crown rating. An impressive 50% of funds in the Europe ex UK sector are 4 or 5 Crown rated and 28% are 5 Crown rated. Similarly, Global Emerging Markets has fared well with 40% achieving 4 or 5 FE fundinfo Crowns. Conversely, the IA UK Equity sector saw a total of 44 funds being downgraded and only two funds were rated with the full five Crowns. Many well-known funds in the sector have suffered with LF Woodford Equity Income seeing the five Crown Rating it was awarded just six months ago fall to one. Rathbone Income and Trojan Income have also seen slips in their Crown ratings - from five to two.

Looking at outright numbers of 5 FE fundinfo Crown rated funds, Old Mutual Global Investors - who were in first place at the last rebalance - now share their top spot with GAM. The two firms are tied with 11 FE fundinfo 5 Crown rated funds each. This rebalance marks Baillie Gifford’s first entry into the top three having previously occupied 15th place in July 2017.

There are 54 funds upgraded by two or more FE fundinfo Crowns to achieve the top accolade of 5 Crowns this rebalance and a third of these are fixed income funds.

How can these ratings help Advisers and Planners?

Intermediaries can access the ratings via FE Analytics or on factsheets on Trustnet.

We believe that quantitative ratings have an important role to play in supporting accurate and fair comparisons of historic performance.

FE fundinfo Crown ratings are calculated by building up a ‘crown score’. The score is made up of three parts, and each part is calculated by reference to a benchmark for the fund. Once the benchmark is assigned, we then apply three tests (an alpha based test, a volatility score and a consistency score) to the total return history of the fund. Three years of history is required to carry out these scores, so any fund with less history than this will not qualify for a rating.

Funds are assigned ratings based on their total scores, according to the following distribution:

- the top 10% - 5 FE fundinfo Crowns

- the next 15% - 4 FE fundinfo Crowns

- the next 25% - 3 FE fundinfo Crowns

- the next 25% - 2 FE fundinfo Crowns

- the bottom 25% - 1 FE fundinfo Crown

No matter what your investment style is, the extensive due-diligence undertaken to create the list can add significant value to your proposition.

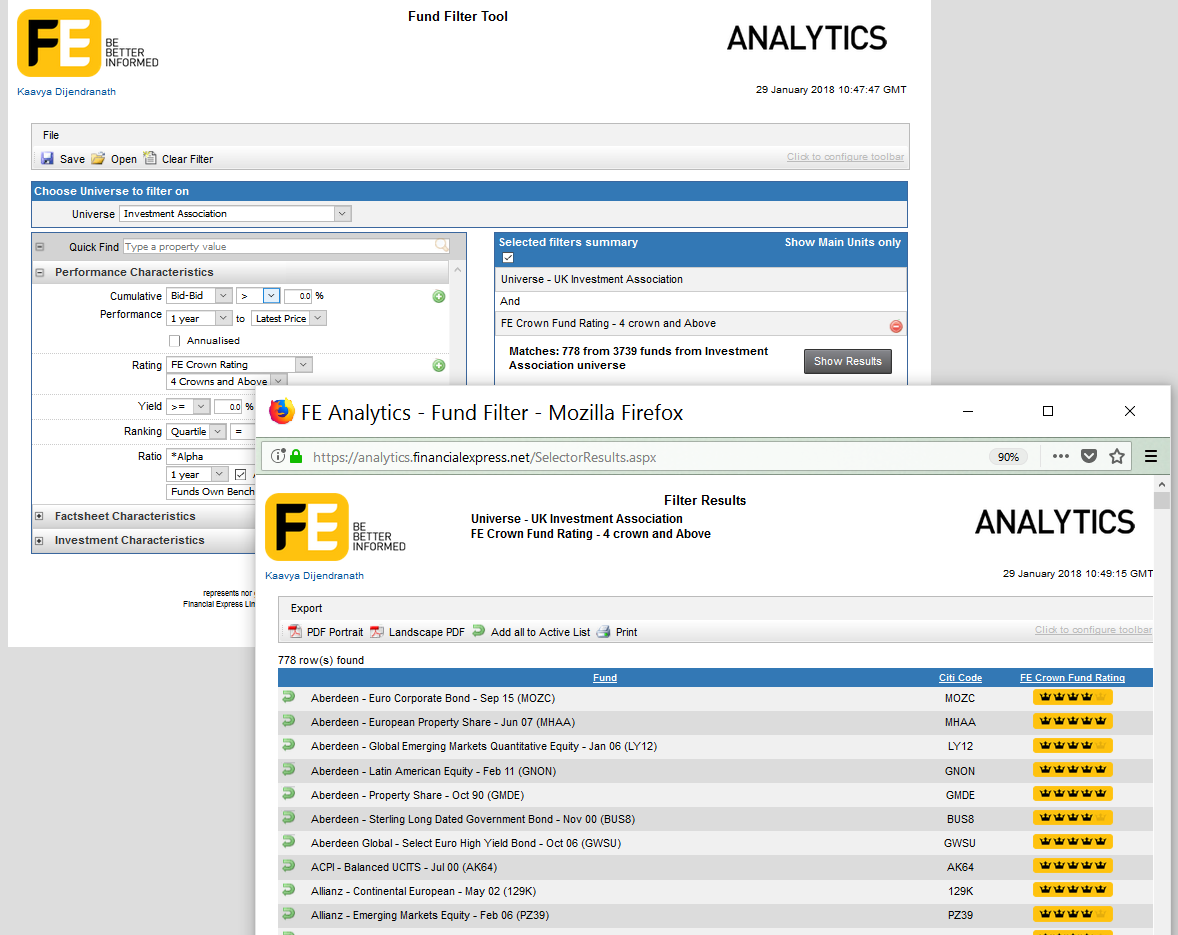

If you build client portfolios or models: For many Advisers who use FE Analytics, the Crown Fund Ratings are a robust metric for investment selection. The filter tool on the system allows your to sieve through the IA universe to select funds with a four or five rating. In other words, in a matter of minutes you have selected a range of funds that have a strong performance history.

The Crown Fund Rating can be included in reporting for clients or compliance as a symbol of the validity of your research and investment selection.

If you outsource: You can also access the ratings through FE Investments, our risk-optimised suite of model portfolios. As high conviction 10 fund portfolios - we select funds after careful scrutiny and their Crown Fund Rating is a key element of this scrutiny. The FE fundinfo Approved Fund List which is a shortlist of funds upon which the models are based, looks at the FE fundinfo Crown Fund Rating, alongside our other ratings i.e. FE fundinfo Alpha Manager, FE fundinfo AFI and FE fundinfo Group Ratings to qualify funds.

Free from bias:

The FE fundinfo Crown Fund Rating is free from any bias. All the funds that fall within the IA universe that have the required history are included in the calculations and analysis. Asset Managers only pay to use the ratings they have achieved but not to be rated. Our objective is to make the market more transparent and accessible, to truly help people be better informed.

For more information please contact us at [email protected]

Asset manager questions/enquiries: [email protected]