- Blackrock (iShares) tops groups table

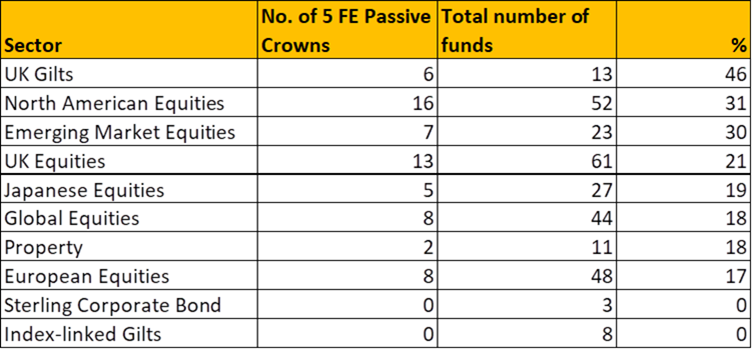

LONDON, 1 AUGUST 2018: FE, the leading UK investment ratings and research agency, today announced that almost half (46%) of UK Gilts funds and a third of both North American Equities (31%) and Emerging Market Equities (30%) funds achieved the highly-prized five FE Passive Crown Rating at the latest rebalance, whilst no Index-linked Gilts or Sterling Corporate Bond funds achieved the top accolade for a second rebalance in a row.

In total, 290 passive funds were rated in the bi-annual FE Passive Crown Ratings rebalance. The ratings are designed to check how well a passive fund is doing its job at tracking its benchmark over three years. Funds are ranked objectively and transparently using a quantitative methodology in which funds are ranked between one and five FE Passive Crowns. [1]

Oliver Clarke-Williams, portfolio manager at FE, said: “The success of UK Gilts can largely be explained by the fact that they are highly liquid and easy to replicate. Similarly, as the largest equities market, North American Equities are the most efficient making them easier to reproduce. More surprising is that there are so many five Crown rated emerging markets funds as it is generally seen as quite a difficult market to copy.”

Groups

At a group level, Blackrock (iShares) retains the top spot with 23 five FE Passive Crown rated funds compared with 22 last time around, while Vanguard retains second place with 11, having achieved 12 in the previous rebalance.

Newly Rated Funds

This rebalance saw eight funds rated for the first time due to their meeting the three-year performance history requirement. One of these funds soared to a five FE Passive Crown Rating at the first time of asking: Xtrackers Russell 2000 UCITS ETF.

FE’s latest Passive Crown Ratings follow the recent active FE Crown Rating rebalance in July 2018. FE launched its FE Passive Crown Ratings in 2015 as there had been a gap in the availability of quality research on passive funds owing to their complexity.

Oliver Clarke-Williams commented: “Too much of the active passive debate has been focused on the ability of active managers, whilst passive funds have been considered more or less equal. The dispersion in quality among passive funds is almost as great as it is among active funds and poor tracking and high charges can cause major underperformance that most people wouldn’t consider possible. It is important to put as much effort into identifying a good passive fund, as a poor choice can be just as destructive to wealth.

“What the ratings show is that past tracking ability of a passive fund can be used as a guide to how well that group will track an index in the future.”

[1] See notes for Editor for more information on methodology.

-ENDS-

For more information contact the FE press team at [email protected]